ANALYSIS: Currency free fall not yet, capital flight temporary

Manila, Philippines – The dollar outflows stemming from a corruption scandal that spooked investors – and their consequent drag on the peso and the economy – should just be temporary, economists said.

While the peso on Tuesday, Oct. 28, saw its worst performance by far at P59.13 against the greenback, and sank to a trough of P59.26 the day after, its tumble is not yet a free fall, BPI lead economist Emilio Neri, Jr. said.

A currency free fall, which essentially is a sharp decline versus another currency, would be another downside risk to an economy whose prospects are already clouded by soft domestic demand both from consumers and businesses. External factors from steep Trump tariffs that cool exports growth and lower US interest rates are not helping either.

“The recent depreciation of the peso is far from a free fall. The peso’s movement has been gradual and contained with the currency down only about 1.4% year-to-date, which is very manageable,” Neri told NewsWatch Plus on Oct. 30.

“The depreciation has also been milder than that of other Asian currencies like the rupiah, dong, and rupee. As long as the peso’s weakness remains in line with regional trends and doesn’t deviate too much from the performance of other currencies, it can be considered a normal adjustment rather than a free fall,” he said.

The central bank had moved swiftly to cut rates earlier this month, and has turned more dovish, as it flagged subdued inflation and softening growth arising from infrastructure spending concerns. Bangko Sentral Governor Eli Remolona had said at the time that a “credible resolution” is necessary to allay investor worries over governance that eclipses any economic drag from the external front.

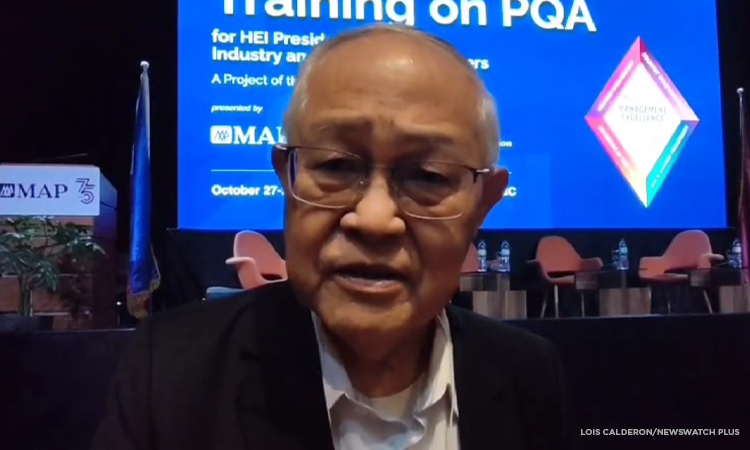

Renowned economist Jesus Estanislao, the finance secretary and economic minister of the late former President Corazon Aquino who hurdled a number of coup attempts that upset the economy, said this episode of political uncertainty should be short-lived.

"Very temporary. The moment we band together, all of that capital will come back,” Estanislao said in a NewsWatch Plus interview on Oct. 28.

But he echoed Remolona’s call for a resolution.

“But we have to bring these 76 construction industry associations together and say, ‘Let’s clean up the mess we have.’ Mechanisms that enable them to meet global standards,” Estanislao said.

BPI expects the peso to end the year at a firmer P58.20 against the greenback, thanks to seasonal dollar inflows from Filipinos living and working overseas. But the local currency could probably hit another all-time low of P59.70 in 2026, based on the bank’s forecast.

“Depreciation pressure on the peso may persist as the country’s trade deficit remains substantial, reflecting strong import demand,” Neri said.

“Expectations of additional monetary easing may also contribute to this as traders price in the possibility of lower interest rate differentials,” he added.

The central bank will convene its last rate-setting review for the year in December and already signalled it is unlikely to unwind its easy monetary cycle anytime soon. Financial markets meanwhile have been pricing in more rate cuts by the US Federal Reserve.