Metro Manila, Philippines – The Bureau of Internal Revenue (BIR) has temporarily suspended audits and operations by its field offices, with certain exceptions, shortly after a lawmaker sought an investigation into complaints of extortion and other corrupt activities preying on small and large-scale businesses.

In a statement on Monday, Nov. 24, BIR Commissioner Charlie Martin Mendoza announced that he has ordered the immediate suspension of the issuance of Letters of Authority (LOA) and Mission Orders (MO), as well as other field audits and operations.

“No LOA or MO shall be created, printed, signed, or served during the suspension period,” Mendoza said.

An MOA, signed by the regional director, authorizes surveillance activities on identified business establishments, while an LOA empowers the BIR to examine a taxpayer’s records, books, and other documents for tax compliance, marking the start of a full-blown audit.

Mendoza said the temporary suspension exempts urgent or legally mandated cases such as active criminal investigations, one-time transactions, audits prescribing within six months, refund claims that require audit, and immediate action on taxpayers flagged by verified intelligence.

“This suspension is necessary to protect taxpayer rights, strengthen internal discipline, and ensure the integrity of our audit processes. We take every complaint seriously, and any misuse of authority, harassment, or irregularity has no place in the Bureau,” Mendoza said.

He added that he has also ordered the creation of a technical working group to evaluate existing procedures and recommend revised protocols.

Newly appointed Finance Secretary Frederick Go, who oversees the BIR, said the move was in response to concerns raised by taxpayers regarding the issuance of LOAs and MOs.

“The Department of Finance is committed to protecting our taxpayers from potential abuse through a comprehensive review of our existing policies and procedures,” he said.

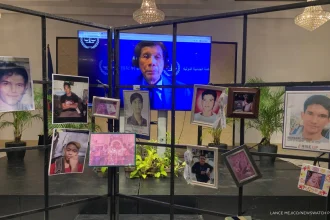

Tulfo bares complaints

While the DOF and BIR did not detail the complaints received, Senator Erwin Tulfo – in a press conference earlier that day – cited numerous reports of BIR personnel using LOAs for harassment, bribery, and extortion.

He filed a resolution urging the blue ribbon committee to investigate what he described as a pattern of systemic abuse and corruption in the BIR, detailing complaints such as:

+ repeated issuance of LOAs to the same taxpayers year after year, creating a cycle of pressure and payoffs;

+ use of fake or unauthorized LOAs to extort money from unsuspecting businesses;

+ substitution of MOs in place of LOAs to evade oversight and scrutiny;

+ reassignment of audits without proper documentation, eliminating paper trails and accountability;

+ and unauthorized or untrained personnel being named in LOAs, compromising the integrity of the audit process.

Tulfo said some firms are also offered “discounts” to avoid inflated tax liability assessments in exchange for kickbacks, with alleged payments reaching millions and involving examiners and even regional directors.

“I’ll give you an example. Kunwari po, ang tax ay nasa P25 million, ang babayaran mo. So, sample lang to, maliit lang ho yan. Sasabihin, “reresibohan kita.” May discount naman, reresibohan kita ng P15 million. Pero sa akin na yung P5 million,” Tulfo recalled.

The lawmaker added that such practices have long existed in the agency but worsened last year, allegedly under former Commissioner Romeo Lumagui Jr., who he said must face the Senate probe.

Tulfo said his office has received at least five complaints from businessmen, with other lawmakers receiving similar reports.

“Handa po silang magbigay ng mga dokumento. Natatakot po sila kasi baka habulin po sila,” he said.