Metro Manila, Philippines – The Philippines has successfully exited the Financial Action Task Force (FATF) grey list, marking a significant milestone in the country’s ongoing efforts to combat money laundering and terrorist financing.

The country’s removal from the list is expected to lower costs for international fund transfers, benefiting both businesses and individuals.

Being on the FATF greylist subjected the country to enhanced monitoring, creating challenges for banks and other financial institutions, while also discouraging international financial transactions.

In a statement, the Presidential Communications Office said that with the exit, the country anticipates more efficient and cost-effective cross-border transactions, improved financial transparency, and reduced compliance barriers—benefits that are expected to boost businesses, attract foreign investments, and support overseas Filipino workers (OFWs).

President Ferdinand R. Marcos, Jr. previously issued Executive Order No. 33, which outlined steps to address the FATF’s action plan.

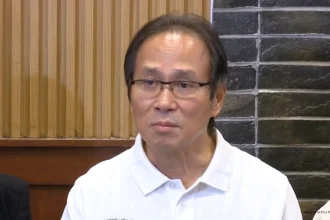

Executive Secretary Lucas P. Bersamin welcomed the FATF’s decision, noting that it confirms the alignment of the Philippines’ anti-money laundering framework with global standards.

The Anti-Money Laundering Council (AMLC), in a separate statement, emphasized the collaborative effort behind this achievement, highlighting the roles played by both the government and private sector.

On Sunday, the Department of Justice also lauded the National Prosecution Service for its role in leveling up the investigation and prosecution of money launderers and terrorism financiers.

“The prosecutors are a vital cog in the proactive effort in the investigation and prosecution of all forms of financial crimes to maintain the country’s financial integrity,” Justice Undersecretary Jesse Hermogenes was quoted as saying.

The Philippines had been placed on the greylist in 2021 and was given 18 action items to address in order to secure its exit.

Countries on the greylist are closely monitored, with the risk of being blacklisted if corrective actions are not taken.

Prior to the greylisting, foreign regulators had already imposed stricter requirements on financial institutions dealing with entities from countries deemed to have weak anti-money laundering measures, leading some banks to avoid these relationships.

Not a victory for groups?

Meanwhile, the National Union of People’s Lawyers (NUPL) criticized the removal of the Philippines from the FATF’s “grey list,” explaining that the international organization did not acknowledge the “rampant misuse of counterterrorism financing laws to silence dissent and criminalize civil society.”

“The surge in fabricated terrorism financing cases, arbitrary asset freezes, and instances of financial exclusion are not ‘unintended consequences’ of compliance; they are deliberate tactics used to satisfy the FATF’s mandates at the cost of human rights,” the NUPL said in a statement Saturday.

The NUPL said in pursuing FATF compliance, the government has “allowed CFT (combatting the financing of terrorism) regulations to be used to harass grassroots movements, all while failing to address large-scale corruption, illicit financial flows, and the billions of pesos laundered through Philippine Offshore Gaming Operators (POGOs).”

“As long as the FATF refuses to engage with civil society, it will continue to serve as a convenient shield for governments to legitimize repression under the pretense of financial integrity,” the lawyers group said.

NewsWatch Plus multiplatform producer Jelo Ritzhie Mantaring contributed to this report.