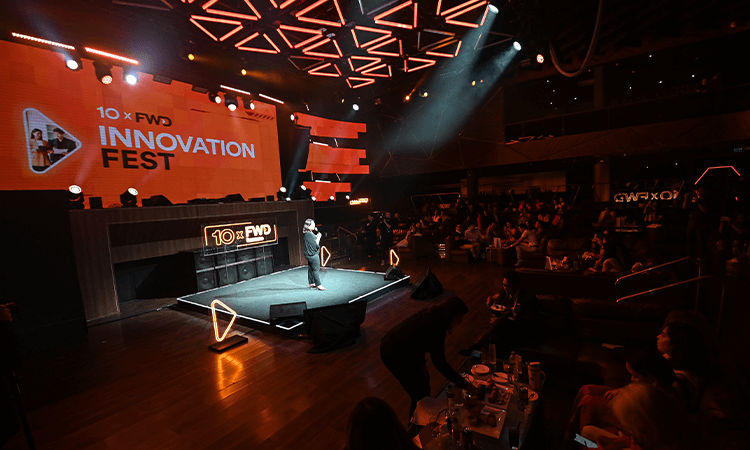

Metro Manila (CNN Philippines) — In 2022, less than 2% of Filipinos had an insurance policy under their belt, which is one of the lowest rates in Southeast Asia. With the pandemic finally starting to ease its squeeze on the ways we live and work, FWD Life Insurance has rolled out several initiatives to make insurance more accessible to Filipinos from diverse backgrounds, with varying needs and budgets. The company showcased its ongoing endeavors to make insurance more inclusive, including developing cutting-edge products and services, helping increase financial literacy and fostering a culture of innovation within the organization at its inaugural Innovation Fest, commemorating FWD Philippines’ upcoming 10th anniversary.

“We want Filipinos to have access to relevant insurance, sensible services, and inclusive programs to close the financial gap and ultimately help in nation-building,” said FWD Philippines President & CEO Antonio Manuel “Jumbing” De Rosas. “When more people are empowered, everyone can provide more opportunities for one another.”

Increased accessibility, enabled by AI

FWD Philippines is currently leveraging AI technology to help customers plan their finances and long-term goals more effectively, and be better equipped to decide which type of insurance to purchase based on their lifestyles and needs. The company unveiled two services at the event — FWD AI Protection Score, which will suggest relevant products to enhance their financial health coverage for added security, and FWD’s AI chatbot Fi, which will help customers discover protection gaps by benchmarking their existing coverage against people with similar profiles.

“Innovation is in our DNA at FWD, and it fuels our unrelenting drive to set the benchmark as the insurer of the next generation,” said FWD Philippines Chief Information & Transformation Officer JC Principe.

“We continue to harness technology, data analytics, and consumer insight to offer inclusive and first-in-the-market products and services,” he also said.

Platforms that enable accessibility and convenience

FWD Philippines is committed to innovating in the insurance space and has embraced technology to offer customers products that are easy to understand, buy and claim. For example, the company’s fully enhanced online shop is designed to make the insurance process smoother through paperless transactions and is accessible 24/7. In just a few clicks, the shop enables direct gifting of insurance policies to family members and loved ones and offers exclusive rewards for online transactions.

FWD’s recently launched 2-in-1 mobile app, Omne, focuses on simplifying policy management and also incorporates lifestyle elements into the user experience. The app enables users to file claims, manage and track investments, switch funds and pay premiums, while also incorporating health monitoring, HIIT workouts, mini-games, and reward vouchers to foster micro-habits and achieve daily goals.

Financial literacy, gamified

As of 2022, the World Bank reported that only 25% of Filipinos have financial literacy. To help the masses achieve financial health, FWD Philippines recently launched Pinoy Money Master, the country’s first ever online game show that blends pop culture and financial literacy.

It features the battle of generations — Gen Z, Millenials, and Gen X — and shows how they are successfully managing their finances and planning for the future. The first episode is available to stream with more to come this September on FWD Philippines’ Facebook page.

FWD is also the official insurer of the upcoming 12th season of Mobile Legends: Bang Bang Professional League (MPL). Its “The One for Gamers” insurance policy was also announced and will be available on FWD’s online shop. An exclusive offer during MPL Season 12, The One for Gamers is an insurance plan that can be customized to include critical illness and accidental death benefit, and uniquely comes with Mobile Legends’ in-game rewards.

Fostering a forward-looking culture of innovation

The company is also looking to continue empowering the next generation with a platform to transform the insurance industry. Since 2021, FWD’s SpringboardX Student Challenge excites students across 10 markets in the Asia region to come up with innovative and impactful solutions for real-life business challenges. SpringboardX Student Challenge will commence on Aug. 28 and is open (and free) to students from all academic backgrounds.

“FWD is 10 years young, and we take great pride in our journey thus far,” De Rosas said. “We are excited to share our latest first-in-the-market initiatives that redefine the possibilities of what an insurance company can achieve. Our goal is to empower more Filipinos to celebrate living.”