Metro Manila (CNN Philippines, March 15) — Lawmakers have asked banks and other businesses to allow the late payment of loans, mortgages, and bills to help Filipinos cope amid the novel coronavirus pandemic.

Senator Grace Poe issued the call on Sunday, saying that companies as well as government lenders should temporarily stop charging penalties and surcharges for late payments as the country is under a state of public health emergency.

“We seek the compassion and goodwill of companies in making sure that there will be no service interruption, disconnections or penalties as a result of the unwanted delay in payment,” Poe said in a statement.

RELATED: DOTr orders: No motor taxis, one-seat-apart in PUVs

“Everyone wants to settle his obligations on time. However, this pandemic has brought unintended consequences that have affected the financial condition of the public, especially workers who are on no work, no pay scheme,” she added.

Work in the Executive branch of government has been cancelled while classes in all levels have been suspended until April 14, 2020 as Metro Manila is placed under “community quarantine.” Travel to and from the region has also been restricted, while other provinces and cities followed suit. The private sector has also been “encouraged” to allow work-from-home or flexible hours for its employees to contain the spread of the disease.

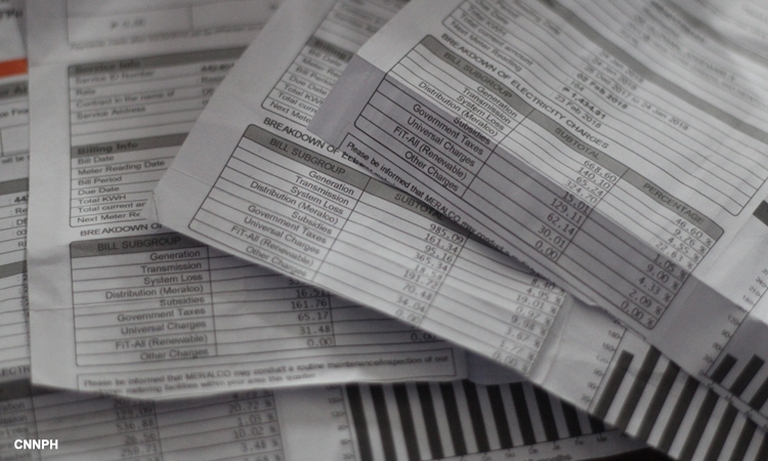

Without an amnesty, Poe said customers would risk lining up in banks and payment centers just to settle their dues, out of fear that their access to utilities would be cut off. She said this would run counter to “social distancing” and would risk more people getting infected.

In a separate proposal, economist and Albay Rep. Joey Salceda also called for rent relief as well as deferred interest and payment deadlines for bank loans. Citing data from the Bangko Sentral ng Pilipinas (BSP), Salceda said deferring payments for credit card and salary loans as well as home mortgage would only cost banks less several million pesos.

The congressman said rents due this March should instead be spread out for a year. The move will encourage families to remain at home rather than worry about paying their rent and debts as the country remains under a health crisis. He also called on the Bureau of Internal Revenue to waive penalties and surcharges for income tax payments, which are due April 15.

The BSP has announced regulatory relief for banksaffected by the COVID-19 pandemic, which allows these lenders to restructure existing loans for longer payment periods. The measure also allows banks to defer its payment of regulatory fees to the central bank. In turn, the banks are “strongly encouraged” to suspend fees and charges for customers using online banking platforms to “facilitate banking transactions during the COVID-19 situation.”

Meanwhile, Salceda also called on the Civil Service Commission to issue rules that would allow state agencies to pay salaries to contractual or job order employees in government, even if they stay home during the quarantine period.

READ: How to work from home without losing your sanity

Salceda also proposed negative interest rates on loans for businesses, especially for the tourism sector. This is meant to be an incentive for these companies to keep their employees, despite the slowdown in demand for their services.